Newly built car report card in February: ideal win, Nezha rebound, zero run on the street.

Editor’s Note: This article comes from WeChat WeChat official account Shenrancaijing (ID: shenrancaijing). Author: Zou Shuai, editor: Dawn, Entrepreneurial State is reproduced with authorization, and the first picture is from the photo network.

January’s collective street beating is still in sight. Did the new forces of building cars return to blood in February?

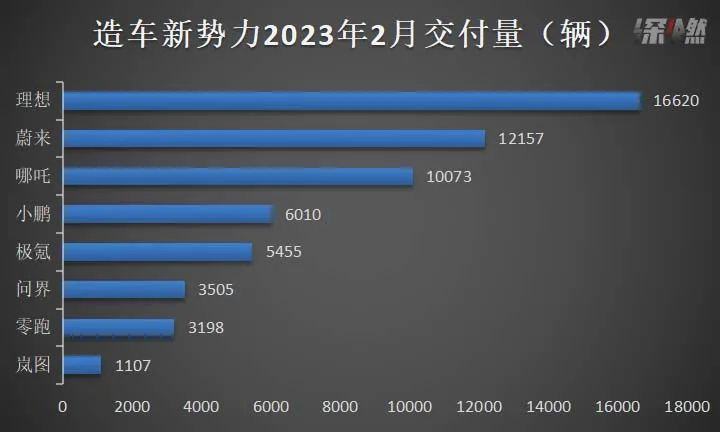

On March 1st, the February sales data of new car-making forces arrived as scheduled. The leader is still ideal, with the delivery volume of 16,620 vehicles in February, up 97.5% year-on-year, and 1,479 vehicles more than last month. After the setback in January, Weilai also returned to 10,000 vehicles, with a delivery volume of 12,157 vehicles, up 98.3% year-on-year. The delivery volume in Tucki was less than 10,000, with only 6,010 vehicles, which was still down year-on-year, but increased by 15% compared with last month.

The momentum of the second echelon is also very strong. Nezha delivered 10,073 vehicles in February, and the last time Nezha delivered 10,000 vehicles in a month was last November. 3,198 vehicles were delivered at zero run and 5,455 vehicles were delivered at extreme krypton.

It is still in the off-season, and it is still too early to discuss the momentum and follow-up actions of the new forces that build cars. However, there are several changes worthy of attention: First, the subsidies of new energy countries have been withdrawn this year, which is a big test for new forces. Whether they can maintain the growth trend, or at least not to fall behind, depends on the ability of each family. Second, influenced by the "price butcher" Tesla, "Wei Xiaoli" has made price reduction adjustments this year, and it is necessary to observe whether the market pays the bill.

The main players are temporarily out of the sales gloom in January, and the car circle is still lively. Tucki P7 is revised, and the ideal L7 is about to be delivered. Wei Laiqing’s "866" and "775" are about to stir up the beams, and Weimar’s chicken feathers have not been cleaned yet. It is conceivable that there will be many variables to happen in the future, and the new forces should also set a plate and what trump cards they have.

The ideal is "close to the ideal" and Tucki is "unable to fly"

As usual, let’s name the new forces first.

The sales crown in February was ideal, with a delivery volume of 16,620 vehicles. In the same period last year, the ideal delivery of 8414 vehicles has doubled. The second place was Weilai, which delivered 12,157 vehicles. This month, Nezha returned to 10,000 vehicles and delivered 10,073 vehicles, winning the third place.

Tucki still didn’t run, and only 6,010 vehicles were delivered in February. As of the time of publication, the official of the press has not announced the delivery volume in February. According to the production and sales express of Sailis Group, the sales volume of Sailis cars (including AITO series) in February was 3,505. 5455 vehicles were delivered in Krypton and 3198 vehicles were delivered in Zero Run.

Cartography/deep combustion

In February this year, both Weilai and Ideality achieved a year-on-year increase of nearly 100%, and only Tucki was slightly embarrassed, with a year-on-year decrease of 3.45%. In the second half of last year, the state of Tucki was very general, and it went down all the way from August to November. In 2023, it seems that Tucki hasn’t recovered in the first two months.

These days, when the ideal sits on the pin crown, it looks very stable. The situation in January is quite special. With the Spring Festival holiday and the withdrawal of subsidies from new energy countries, the monthly performance of new car-making forces is relatively low, and only ideals have maintained a momentum of over 10,000. In February, although it was still in the off-season of sales of new energy vehicles, it kept the trend of rising delivery volume, with 1,479 vehicles more than last month.

Weilai’s delivery in February increased by 42.92% month-on-month, and the surge in delivery was probably related to its inventory clearance activities in that month. Now, only a few old models ES8, ES6 and EC6 are on sale, and "866" is about to bid farewell to the historical stage. It is "775", that is, ET7, ES7 and ET5.

The delivery data in February also shows how well the handover of "866" and "775" has been done. In January, Weilai sold 2,190 SUVs (ES7, ES6, EC6 and ES8), accounting for 25.75% of the total delivery, and 6,316 cars (ET5 and ET7), accounting for 74.25% of the total delivery. It can be seen that SUVs including "866" old models are not the main sales force, and the proportion of SUVs and cars is not small.

Looking at the situation in February, 5037 SUVs and 7120 cars were delivered. The delivery of SUVs accounted for 41.43% of the total delivery, and cars accounted for 58.57%. The proportion of SUVs increased significantly. It seems that "866" sold well.

Next, the first echelon also has key nodes that need to be tested. Ideal L7 was officially launched on February 8th, and it is the first 5-seat version of the ideal vehicle. According to the news, Pro and Max models will be delivered one after another on March 1, and Air models will be delivered one after another in early April. The results of the new car will not be seen until the delivery data in March and April. This time is well timed. After a part is delivered in March, the sales volume in the first quarter may be guaranteed. After another delivery in April, the beginning of the second quarter is also a "good start".

In March, the redesigned Tucki P7 will enter the market under the new name P7i. The arrival of the new P7 is very important for Tucki to fight a "turnaround". According to the news, the new car has been upgraded with lidar, and Tucki is still willing to invest in the auxiliary driving of new energy vehicles. And Tucki’s ability in intelligence is also the reason why the outside world still has confidence in it.

Nezha desperately wants to squeeze into the top three. In February, Nezha’s report card was not bad. According to the official, Nezha S recorded 2,048 sets in February, up 35% from January, accounting for about 20% of the total sales in that month. From the perspective of total delivery, the year-on-year and month-on-month increases were 41.5% and 67.4% respectively, and the trend of blood return was obvious.

Nezha’s record in February, to a certain extent, can also be confirmed, and its price increase has passed smoothly. In January, Nezha raised the prices of some models, with Nezha S, Nezha U-II and Nezha V each increasing by 3,000-6,000 yuan, with Nezha S having the highest price after adjustment, ranging from 202,800-341,800 yuan.

The reason for the price increase is that Nezha wants to hit the market upward.

Last July, Nezha became the top seller of new cars for the first time, and it also held the first place from August to November. However, compared with others, only from Nezha’s own situation, the delivery volume in October was 18,016 vehicles. Since then, the monthly delivery data has been falling all the way, even falling out of the 10,000-vehicle mark. Last December, everyone did well, but only 7,795 vehicles were sold in Nezha, down 48% from the previous month.

In January this year, the monthly delivery volume of Nezha was the lowest in the past year, with 6,016 vehicles. After four months of continuous decline, the outside world began to suspect that Nezha’s hot wheels was no longer useful. Nezha’s style of play has always kept a big gap with "Wei Xiaoli". "Wei Xiaoli" occupies the mass market of 100,000-300,000 yuan, and the middle and high-end market of 300,000-500,000 yuan. Nezha has targeted the low-end market from the beginning, focusing on models below 200,000 yuan. The exchange of price for quantity has indeed brought about the rapid growth of Nezha, and it is not surprising to reach the top.

However, the fatigue in delivery means that it is difficult for this strategy to push Nezha further. Price increase is a risky move, but "seeking wealth and risk".

In the second echelon, another thing worthy of attention is the zero run. In February, Zero Run and Tucki were the only car companies that saw a year-on-year decline in sales. In January of this year, the delivery volume of zero-running was only 1139, which was the bottom of the month. Compared with January 2022, it plummeted by nearly 80%. In February, 3,198 vehicles were delivered at zero speed, which is still far from 10,000 vehicles.

In February, the run-by-run C11 extended-range version officially opened for pre-sale, with the pre-sale range of 159,800-200,000 yuan, and will be delivered in mid-March. In the face of weak sales for several months in a row, the zero-run may have to open the market by increasing the program.

The growth rate of krypton is second only to zero run. In February, 5,455 vehicles were delivered, an increase of 87.07%. Krypton once triumphed all the way, once surpassing Tucki. After jumping on the street with various families in January, its recovery situation in February was relatively clear. However, the "hidden worry" of extreme krypton is hard to ignore. Recently, there have been a lot of controversies about "extremely Kryptonian car owners", "non-refundable orders" and "two-faced". It remains to be seen whether the crisis in public opinion will affect the momentum of extremely Kryptonian.

Lantiu and Wenjie are the only car companies with a month-on-month decline. Lantu delivered only 1,107 vehicles, compared with 1,548 vehicles last month. The sales volume of the industry was 3,505 vehicles, a decrease of 21.68% from the previous month.

Weimar is still invisible. Employees leave their jobs without pay, factories shut down, suppliers cut off their supply, and there is no door after sale. These may be issues that Weimar should be more worried about. On February 27th, according to the staff of the Labor and Social Security Supervision Bureau of Huanggang Municipal Bureau of Human Resources and Social Security, the Municipal Labor and Social Security Supervision Bureau and the Municipal Department of Human Resources and Social Security have set up a special class to intervene in this matter and are accepting the rights protection of Weimar employees.

The state of several second echelon can be divided into two categories. One is Nezha and Zero Run, both of which showed fatigue in the past period of time and picked up in February. The other is extreme krypton, Lan Tu and Wen Jie, who walk slowly in small steps, but at the same time walk carefully.

As early as before each company announced its sales volume, some insiders predicted that the delivery volume would probably increase in the off-season this year. The reason is obvious, the price has been reduced, and the volume has gone.

The biggest strength is Wei Lai. According to the limited-time preferential car purchase plan released by Weilai’s official community in February, in February 2023, users who bought 2022 ES8, ES6 and EC6, that is, the old model "866", Weilai covered the state subsidy in 2022. It is understood that the "866" model is no longer customized, so it is also stated in the plan that only a small number of 2022 ES8, ES6 and EC6 long-term exhibition cars can be purchased by users, and they can enjoy additional exhibition discounts according to different storage ages and vehicle conditions. Users who purchase ES8 exhibition cars can enjoy a maximum cash discount of 24,000 yuan, while users who purchase ES6 and EC6 exhibition cars can enjoy a maximum discount of 18,000 yuan.

Weilai’s price reduction has also received a response from Qin Lihong, president of Weilai. It is rumored that Weilai will reduce the price by 100,000 yuan, but Qin Lihong said that in fact, there are very few models with a total discount of 100,000 yuan. He also explained that the price reduction of "866" is because Weilai is clearing the first-generation model and preparing for the "866" model of the second-generation platform.

Weilai’s decline is about 20,000 yuan, and the situation in Tucki is similar. On January 17th, Xpeng Motors lowered the prices of G3i, P5 and P7, with an overall decrease of 20,000-36,000 yuan. Since February, Tucki has given an insurance subsidy of 7,000 yuan and a final payment subsidy of 10,000 yuan for specific models, and the maximum discount is nearly 50,000 yuan.

Weilai, who once shouted that he would not cut prices, can’t hold back now? In fact, it is normal for the new and old models to alternate, and it is normal to reduce prices and promote sales because of clearing inventory. From the perspective of Weilai’s strategy, it is reasonable to hand over the "866" to the next generation.

In addition, a necessary prerequisite for the replacement of old and new cars is that old cars can’t be sold. Take Weilai as an example, the sales of the three models of "866" all dropped by 1,000 units in January this year. EC6 bid farewell to four figures from last September, and the last one was ES6, which delivered 872 vehicles in January this year and 1,731 vehicles in December last year. Not surprisingly, the sales of the "866" three cars have also continued to decline in the past six months. In the case of the overall cold of the new energy vehicle market, the "775" all showed a downward trend after November last year. It is necessary to complete the handover drastically at this moment.

There is also room for cost reduction. The price of lithium carbonate, the main raw material of batteries, began to fall in December last year. At present, the price of battery-grade lithium carbonate is less than 400,000/ton. Last year, the highest point was close to 600,000/ton, and now it has dropped by 30%. Some analysts believe that the sales market of new energy vehicles is sluggish at the beginning of this year, the demand for batteries is weak, and the finished product inventory of lithium salt manufacturers is also at a high level, which is cold in the market. In the future, under the influence of the weak price of lithium carbonate, the price of spodumene may also fall further.

Looking back at the industry, new forces have cut prices one after another, and it is difficult to get rid of Tesla, the "price butcher". Recently, it was reported that Tesla may usher in a new round of price cuts in March, with Model 3 dropping to 159,900 and Model Y dropping to 179,900. There is another saying that Model 3 dropped to 199,000. The news has not yet received a response from Tesla.

Two facts are in front of us. First, the rumors of Tesla’s price reduction are probably not groundless. According to its consistent style, price reduction is not only a habitual action, but even a downward trend. Second, the price reduction of Tesla and the price reduction of the new domestic car-making forces are interactive. Tesla gradually approached the price band of the new forces, and the new forces had to cut prices to deal with it.

The industry believes that whether the new energy vehicle market can rebound depends on the situation in the second quarter.

Indeed, the ideal L7 is about to be delivered, and Tucki on hot bricks will also have its own "trump card upgrade", ending the embarrassing situation of being green and yellow, and accepting the market challenge again. Weilai has completed the new generation and the old generation, and the sales data in February also prove that this decision is right and it has been completed well. Next, it is necessary to rely on "775" to conquer the world.

Extreme Krypton, Lan Tu and Wen Jie belong to cumulative players. If there are no big moves, there is a high probability that they will make a steady breakthrough under the general trend. Nezha and Zero Run have gone the same difficult road, becoming high-end and brand-building. As for the result, there should be an answer in the next few months. Of course, the outside world is also waiting for an answer, and there is a silent Weimar.

* The pictures in this article are from pexels. At the request of the respondents, Fan Gao, Tan Lin, A Chen and A Dong are pseudonyms.

This article is published by Entrepreneurial State authorized by the columnist, and the copyright belongs to the original author. The article is the author’s personal opinion and does not represent the position of the entrepreneurial state. Please contact the original author for reprinting. If you have any questions, please contact editor@cyzone.cn.