Finance and economics are once deep | How to grasp the key of real estate finance to implement "housing and not speculating"?

Food, clothing, housing and transportation are the basic needs of life, among which "living" is regarded as just needed by many people. These two days, there was an interesting meeting, which was closely related to "living".

The video and telephone conference on accelerating the development of affordable rental housing and further improving the regulation of the real estate market held on the 22nd reiterated that the house should be used for living, not for speculation, and the real estate should not be used as a short-term means to stimulate the economy.

The positioning of "staying in the house and not speculating" continued to consolidate, which made many people eat "reassuring".

The picture shows a commercial house near Madang Road in Shanghai. Xinhua News Agency reporter Chen Fei photo

Whether buying a house, renting a house or building a house, it is inseparable from money. Therefore, real estate finance is a key link in the implementation of "housing without speculation".

In recent years, China has accelerated the establishment and improvement of a long-term mechanism for real estate financial management, especially under the guidance of the "three lines and four files" rule and the real estate loan concentration management system, many housing enterprises have become more cautious and self-disciplined, and the concentration of real estate loans and personal housing loans of banking financial institutions has steadily decreased.

In June, the sales price increase of commercial housing in 70 large and medium-sized cities showed a steady and declining trend as a whole; At the same time, at the end of June, the growth rate of RMB real estate loans in China dropped by 2.2 percentage points from the end of last year.

It can be seen that the regulatory policies, including real estate financial policies, have been effective, the real estate credit environment in some cities has changed, and the price increase has stabilized.

What is the "sharp weapon" that can make regulation so immediate? How do the "three lines and four gears" rule and the real estate loan concentration management system play a role? Come and get to know it.

To promote the stable and healthy development of the real estate market, first of all, real estate enterprises need to be healthy. However, some real estate enterprises are greedy for perfection and blindly expand, and the financial indicators of core operations are "red light", which also leads to the phenomenon of high leverage and high debt in the real estate industry.

In order to enhance the marketization, regularity and transparency of financing for real estate enterprises, in August last year, the People’s Bank of China, the Ministry of Housing and Urban-Rural Development and relevant departments formed the fund monitoring and financing management rules for key real estate enterprises, that is, the "three lines and four files" rules.

The "three lines" are actually "three red lines", which specifically refer to: the asset-liability ratio is greater than 70%, the net debt ratio is greater than 100%, and the cash short-term debt ratio is less than 1 times after excluding advance payments.

According to the situation of stepping on the line, real estate enterprises are divided into four grades: red, orange, yellow and green: the scale of interest-bearing liabilities of "red-file" enterprises cannot be higher than the existing level; The annual growth rate of interest-bearing liabilities of "orange file" enterprises shall not exceed 5%; "Yellow file" enterprises shall not exceed 10%; "Green file" enterprises shall not exceed 15%.

With a clear "three lines and four gears", housing enterprises must meet the corresponding requirements and constantly optimize financial indicators if they want to raise funds. This is equivalent to a "physical examination" of the financial health of housing enterprises to help them better improve their financial management.

Behind health is self-discipline. When the financing behavior of housing enterprises is more prudent and self-disciplined, the overall operation tends to be stable. Having tasted the sweetness, more and more real estate enterprises have joined the ranks of "self-discipline". At the beginning of the pilot, the central bank selected 12 representative real estate enterprises as the pilot targets, and at the beginning of this year it expanded to 30 real estate enterprises with large debts.

Zou Lan, director of the Financial Market Department of the People’s Bank of China, said that the "three-line and four-gear" rule is effective from the situation and reactions from all walks of life in the past year. The three core operating financial indicators of the pilot enterprises, namely, asset-liability ratio, net debt ratio and short-term cash debt ratio, have obviously improved, and the debt scale has steadily declined. Many other real estate enterprises outside the pilot also actively benchmark the rules and optimize their own business practices.

The picture shows a qionghai city resident passing by an advertising slogan in front of a bank. Xinhua news agency

In addition to keeping an eye on the demand side, financing management cannot ignore the supply side. In addition to monitoring and managing the liabilities of housing enterprises, the People’s Bank of China also strengthens the management of banking financial institutions — — Formulate the management system of real estate loan concentration.

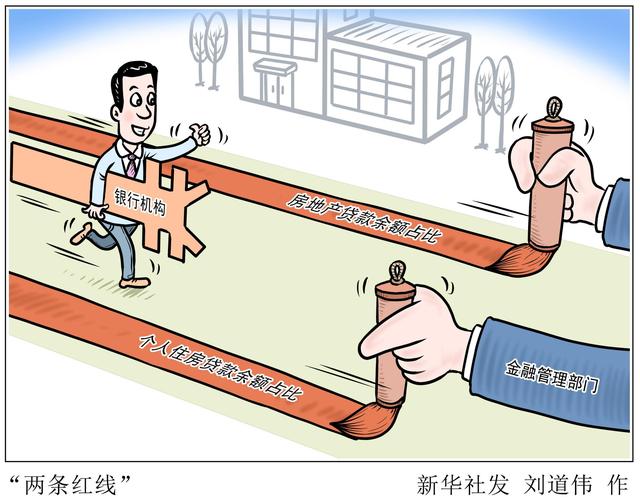

The system sets "two red lines" for the balance of real estate loans and the balance of personal housing loans for different types and sizes of banking institutions. The former ranges from 40% to 12.5%, while the latter ranges from 32.5% to 7.5%.

As the saying goes, eggs can’t be put in one basket. Bank credit should also focus on structural optimization, which is not only related to the risk of the institution itself, but also of great significance to the healthy and steady development of the whole economy.

Since the implementation of the system, the concentration of real estate loans and personal housing loans of banking financial institutions has steadily decreased. The data shows that at the end of June, the growth rate of China’s real estate development loan balance and personal housing loan balance dropped by 3.3 and 1.6 percentage points respectively compared with the end of the previous year.

In Zou Lan’s view, while the real estate loan business is subject to certain constraints, commercial banks have put more energy into supporting small and micro, "agriculture, rural areas and farmers" and other weak economic links, while the proportion of loans in key areas such as manufacturing and technological innovation has been improved.

The data shows that at the end of June, the balance of China’s Pratt & Whitney small and micro loans increased by 31% year-on-year, and the growth rate was 18.7 percentage points higher than that of various loans in the same period; The balance of medium and long-term loans in manufacturing industry increased by 41.6% year-on-year, and the growth rate was 16.9 percentage points higher than the same period of last year.

The People’s Bank of China said that the next step will continue to adhere to the positioning that houses are used for living, not for speculation, implement a long-term real estate mechanism, constantly improve the "three lines and four files" rules and the centralized management system of real estate loans, do a good job in policy implementation, improve the resilience and stability of the financial system, and promote the balanced development of finance, real estate and the real economy.

To firmly grasp the key of real estate finance, we must continue to strictly implement the "sharp weapon" of regulation and control, manage the supply and demand ends of real estate finance, and make the regulation and control policies more precise, which will not only accurately crack down on real estate speculation, but also better meet the needs. (Reporter Wu Yu)