The business review of the Board of Directors of Tuojing Technology in 2022 is as follows:

I. Description of the industry and main business of the company during the reporting period.

(a) the company’s industry

1. Industry and determination basis

The company is mainly engaged in R&D, production, sales and technical services of high-end semiconductor special equipment. According to the Guidelines for Industry Classification of Listed Companies (revised in 2012) issued by CSRC, the company belongs to the special equipment manufacturing industry (industry code: C35). According to the National Economic Industry Classification (GB/T4754-2017), the company belongs to the special equipment manufacturing of semiconductor devices under the special equipment manufacturing industry (industry code: C3562). According to the Classification of Strategic Emerging Industries (2018) issued by the National Bureau of Statistics, the company belongs to the integrated circuit manufacturing industry under the new generation of information technology industry.

2. Semiconductor equipment industry

The development level of semiconductor industry is closely related to the national science and technology level, and its development has become the vane of economic and social development in all countries around the world, and it is an important symbol to measure the modernization degree and scientific and technological strength of a country. As the technical leader of the semiconductor industry chain, semiconductor equipment is the foundation of the development of the semiconductor industry and the key to technological progress, and its self-control is particularly important. With the iterative upgrading of semiconductor technology, semiconductor components are gradually developing towards precision and miniaturization, which constantly challenges the manufacturing technology and makes the important position of semiconductor equipment increasingly prominent.

In recent years, driven by the rapid downstream development, the semiconductor equipment industry has maintained rapid growth. According to SEMI statistics, the global sales of semiconductor manufacturing equipment in 2021 was about USD 102.6 billion, up by 44% year-on-year. In 2021, the sales scale of semiconductor equipment in Chinese mainland reached USD 29.62 billion, up by 58% year-on-year. Chinese mainland was the largest market of semiconductor equipment in the world in 2020 and 2021. In the first quarter of 2022, the global shipment amount of semiconductor equipment reached US$ 24.7 billion, up 5% year-on-year. In the first quarter of 2022, the shipment amount of semiconductor equipment in Chinese mainland ranked first, up 27% year-on-year.

At present, the global semiconductor equipment market is mainly dominated by foreign manufacturers. With China’s continuous policy support and increased investment in the semiconductor industry, domestic semiconductor equipment has achieved a qualitative leap from scratch and from weak to strong, which has continuously improved the ecology and manufacturing system of China’s semiconductor industry. However, China’s semiconductor equipment market is still heavily dependent on imports. Therefore, the domestic semiconductor equipment manufacturers who can achieve import substitution have a large market space and have a huge growth opportunity.

3. Development of the film deposition equipment industry where the company is located.

(1) Market scale of thin film deposition equipment

According to the data of SEMI and Beijing Oulixin, the global market scale of thin film deposition equipment will reach 21 billion US dollars in 2021. According to the proportion of domestic semiconductor equipment market accounting for 28.87% of the global market in 2021, the market scale of thin film deposition equipment in Chinese mainland will be about 6 billion US dollars in 2021, which is about 33% higher than the estimated 4.5 billion US dollars in 2020. In 2022, the global market scale of thin film deposition equipment will continue to grow, which is expected to reach $25 billion, and the Chinese mainland market will also maintain the growth trend, bringing broad market space for domestic thin film equipment manufacturers.

According to SEMI statistics, in the equipment investment of newly-built fabs, the investment in equipment related to wafer manufacturing accounts for about 80% of the total equipment investment. As one of the three major equipment in wafer manufacturing, the investment scale of thin film deposition equipment accounts for 25% of the total investment in wafer manufacturing equipment.

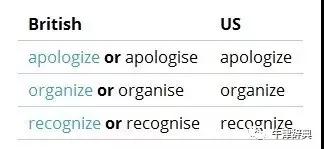

Proportion of investment in semiconductor equipment

(2) Market situation of thin film deposition equipment segments focused by the company.

Thin film deposition equipment mainly includes chemical vapor deposition (CVD) equipment and physical vapor deposition (PVD) equipment. The company mainly focuses on plasma enhanced chemical vapor deposition (PECVD) equipment, sub-atmospheric chemical vapor deposition (SACVD) equipment and atomic layer deposition (ALD) equipment in the field of CVD equipment subdivision. Different kinds of thin film deposition equipment are suitable for different requirements of different process nodes on film quality, thickness and pore groove filling ability.

According to the data of SEMI and Beijing Oulixin, in 2021, PECVD is the highest equipment type among all kinds of thin film deposition equipment in the world, accounting for 33% of the total thin film deposition equipment market, ALD equipment accounts for about 11%, and SACVD belongs to other thin film deposition equipment categories, accounting for less than 6%.

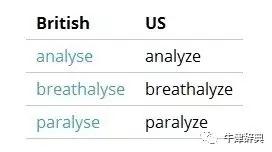

Proportion of all kinds of thin film deposition equipment

(3) Development trend of thin film deposition equipment

① The market demand for thin film deposition equipment is growing steadily.

With the improvement of the overall prosperity of the semiconductor industry, the global semiconductor equipment market shows a rapid growth trend, which drives the market demand for thin film deposition equipment to increase. Maximize Market Research predicts that the global market size of semiconductor thin film deposition equipment will reach 34 billion US dollars in 2025, with a compound annual growth rate of 13.3% from 2020 to 2025. Among them, the market scale of ALD equipment will grow rapidly. According to the market research organization Acumen research and condulting, with the increase in the number of advanced semiconductor manufacturing lines, the global ALD equipment market will reach about 3.2 billion US dollars in 2026.

In recent years, driven by the strong market demand for semiconductor products, the global fabs have expanded their production capacity and gradually moved to Chinese mainland. Chinese mainland has become the new production center of global fabs. SEMI data shows that in 2021-2022, there were 29 new fabs in the world, including 8 in Chinese mainland, accounting for 27.59%. The expansion and construction of Chinese mainland Wafer Factory has accelerated the development and layout of domestic semiconductor industry, providing a huge market space for the development of domestic semiconductor equipment.

According to the statistics of Jiwei Consulting, Chinese mainland is expected to add 25 12-inch wafer factories in the next five years (2022 -2026), with a total planned monthly production capacity of over 1.6 million wafers. By the end of 2026, the total monthly production capacity of Chinese mainland 12-inch wafer fab will exceed 2.763 million wafers. The upsurge of local fabs in China will lead the demand growth of semiconductor thin film deposition equipment in China.

(2) chip technology progress and complicated structure improve the demand for thin film equipment.

Thin film deposition refers to the deposition of a layer of thin film material to be processed on the silicon wafer substrate. The deposited thin film material can be nonmetal such as silicon dioxide, silicon nitride, polysilicon and metal such as copper. Thin film deposition equipment is mainly responsible for the deposition of dielectric layer and metal layer in each step. PECVD, ALD and SACVD products focused by the company are mainly used to deposit dielectric thin film materials, which are widely used in logic chips, 3D NAND FLASH memory chips and DRAM memory chips.

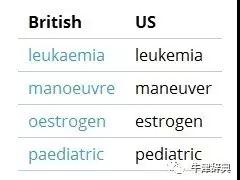

Application of dielectric thin film in logic chip

Application of Dielectric Thin Film in 3D NAND FLASH Memory Chip

Application of dielectric film in DRAM memory chip

The development of thin film equipment supports the development of integrated circuit manufacturing technology to smaller processes. With the iterative upgrade of integrated circuit chip technology, the wafer manufacturing process is becoming more and more precise, the complexity of chip structure is increasing, the required thin film deposition processes and thin film types are increasing, and the requirements for thin film performance are also increasing. This trend puts forward higher technical requirements for thin film deposition equipment, and the market is increasingly dependent on high-performance thin film equipment.

In 90nm CMOS chip technology, about 40 thin film deposition processes are needed. In the production line of 3nm FinFET process, more than 100 thin film deposition processes are needed, and the number of thin film materials involved has increased from 6 to nearly 20, and the requirements for thin film particles have also increased from micron level to nanometer level, thus driving the wafer factory to increase the demand for thin film deposition equipment.

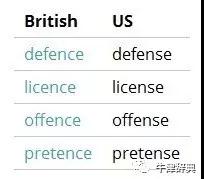

Comparison of thin film deposition processes at different process nodes

In the field of FLASH memory chips, with the development of mainstream manufacturing technology from 2D NAND to 3D NAND structure, the complexity of the structure leads to the increasing demand for thin film deposition equipment. With the increasing number of stacked layers of 3D NAND FLASH chips, from 32/64 layers to 128/196 layers and more advanced nodes, the demand for thin film deposition equipment will continue.

Although the global semiconductor equipment market has a strong periodicity, Chinese mainland’s semiconductor industry is facing unprecedented development opportunities, with national strategic focus, huge market support, benign interaction of industrial chains, increasing industrial capital, increasing number of fabs invested by mainland and international capital, and more advanced manufacturing processes. China’s thin film deposition equipment industry will maintain high growth, and the importance of China market will be further enhanced in the future.

(2) Description of the main business.

1. Overview of the company’s main business

The company is mainly engaged in research and development, production, sales and technical services of high-end semiconductor special equipment. The company’s main products include plasma enhanced chemical vapor deposition (PECVD) equipment, atomic layer deposition (ALD) equipment and sub-atmospheric chemical vapor deposition (SACVD) equipment, which have been widely used in the production line of 14nm and above process integrated circuits in domestic fabs, breaking the monopoly of international manufacturers on the domestic market in the field of high-end semiconductor thin film deposition equipment and competing directly with international oligarchs. At present, the company is the only manufacturer of integrated circuit PECVD equipment and SACVD equipment for industrial application in China, and also the leading manufacturer of integrated circuit ALD equipment in China.

2. The company’s main products

During the reporting period, the company continued to expand the application fields of PECVD, ALD and SACVD products, continuously enriched and improved the functions of mass-produced products, maintained the core competitiveness of products, further enhanced the market share of existing products, and obtained repeated orders from existing customers and new customers in the fields of logic chips and memory chips. The scale of mass production and application of the company’s products in the wafer manufacturing production line continues to expand. By the end of the reporting period, the cumulative number of products produced by the company’s equipment in the client production line has increased from more than 46 million as of December 2021 to more than 71 million. During the reporting period, the company’s equipment performed well in the production and operation stability of the client production line, and the average Uptime of the machine was over 90% (the industry standard is usually over 85%).

On the basis of existing products, the company has actively deployed new product research and development around the subdivision of CVD equipment, and continuously enriched the company’s product categories. At present, it has developed new products such as TS-300 (polygonal high-yield platform), thermal-atomic layer deposition (Thermal-ALD) based on high-yield platform, high-density plasma enhanced chemical vapor deposition (HDPCVD) equipment and ultraviolet curing (UV Cure) equipment.

The company’s existing PECVD, ALD and SACVD products are as follows:

①PECVD series products

PECVD equipment is one of the core equipment in chip manufacturing. Due to the action of plasma, high-density and high-performance thin films can be formed at relatively low reaction temperature, and the existing thin films and the formed underlying circuits are not damaged, thus achieving faster film deposition speed. It is the most widely used equipment type in the film deposition process of chip manufacturing.

The details of PECVD series products are as follows:

②ALD series products

ALD equipment can achieve excellent step coverage and accurate film thickness control with high aspect ratio and extremely narrow trench opening, and realize the precision control of key dimensions in chip manufacturing process. ALD is one of the essential core equipment in the manufacturing of advanced logic chips, DRAM and 3D NAND with complex structure and accurate film thickness requirements.

The company’s ALD series products are as follows:

③SACVD series products

SACVD equipment is mainly used in trench filling process and is one of the important equipment for integrated circuit manufacturing. In the integrated circuit structure, the depth-to-width ratio of trench holes is increasing, and the SACVD reaction chamber environment has a unique high temperature (400-550℃) and high pressure (30-600Torr) environment, which has a rapid and superior Gap fill ability.

The company’s SACVD series products are as follows:

Note: With the continuous enrichment of the company’s product categories, the company continues to improve the product model naming rules. During the reporting period, the company’s product model name was adjusted by implementing the internal decision-making procedures of the company, and the product model was renamed according to the type of equipment platform and the type of reaction chamber.

3. Main business models

(1) Profit model

The company is mainly engaged in research and development, production, sales and technical services of high-end semiconductor special equipment. The company realizes revenue and profit by selling film deposition equipment to downstream customers and providing spare parts and technical services. During the reporting period, the company’s main business income came from the sales of semiconductor equipment, and other business income mainly came from the sales of spare parts related to equipment.

(2) R&D mode

The company mainly adopts the mode of independent research and development. The company has established an international and professional research and development technical team for semiconductor thin film deposition equipment. The company’s R&D technical team has a reasonable structure, clear division of labor, profound professional knowledge reserves and rich experience in production line verification, which is the cornerstone of the company’s independent R&D capability. Guided by customer demand, technical trends of semiconductor special equipment and national major scientific and technological special goals, the company develops and designs new products and processes, manufactures R&D machines, and debugs performance parameters. After passing the company’s test, it is sent to the customer’s actual production environment for industrialization verification, and the products are formally finalized after verification. In addition, the company will continue to enrich and improve the functions of mass-produced products according to the different process application needs of customers.

(3) Purchasing mode

Company procurement is mainly divided into standard parts procurement and non-standard parts procurement. For the procurement of standard parts, the company directly purchases from market suppliers. Non-standard parts are mainly parts designed by the company according to specific technical requirements in R&D and production. For non-standard parts procurement, the company mainly provides design drawings to suppliers and defines parameter requirements, and suppliers purchase raw materials for processing and customization; For specific parts, the company provides drawings and parameters, and supplies raw materials to suppliers, entrusting suppliers to complete customized processing.

(4) production mode

The company’s products are mainly customized and manufactured according to customers’ differentiated needs and purchasing intentions. The company mainly adopts the production mode of combining inventory production with order production. Inventory-based production means that the company starts production before obtaining the formal order, including the production activities started according to the Demo order or the clear customer purchase intention, which is applicable to the company’s Demo machines and some sales machines. Order-based production refers to the production after the company signs a formal order with the customer, which is suitable for most of the company’s sales machines.

(5) Sales and service mode

During the reporting period, the company’s sales model was direct sales, and customers’ orders were obtained through business negotiations with potential customers and bidding. After years of efforts, the company has formed a relatively stable cooperative relationship with domestic semiconductor industry enterprises.

The company’s sales process generally includes market research and promotion, obtaining customer demand and internal discussion, product quotation, bidding operation and management (if applicable), sales negotiation, contract review, signing and execution of sales orders (or Demo orders), product installation and debugging, contract payment, customer acceptance and after-sales service. After the company’s equipment is shipped to the customer’s designated place, it needs to be installed and debugged on the customer’s production line. Usually, after the customer completes the relevant tests, the equipment is accepted, and the company confirms the income after the customer’s acceptance is completed.

During the reporting period, the company’s main business model has not changed significantly.

Second, the core technology and research and development progress

1. Core technologies and their advanced features and changes during the reporting period.

Since its establishment, the company has been focusing on the research and development of semiconductor thin film deposition equipment, forming a series of core technologies with independent intellectual property rights, and reaching the international advanced level. The company’s core technology is widely used in its main business products, which solves the key problems in semiconductor manufacturing, such as uniformity and consistency of nano-scale thin films, small number of particles on the film surface, rapid film formation and stable and high-speed equipment production capacity. While ensuring the realization of film process performance, it improves the production capacity of customer production lines and reduces the production cost of customer production lines. The company’s core technology and its advanced features are as follows:

During the reporting period, the company’s core technology has not changed significantly.

Awards of national science and technology awards

Identification of "individual champions" of national-level "little giant" enterprises and manufacturing industries

2. R&D achievements obtained during the reporting period

The company has always focused on the research and development of semiconductor thin film deposition equipment. During the reporting period, the company was approved to undertake one major national special project. By the end of the reporting period, the company had undertaken seven major national special projects/projects.

The company has a number of independent intellectual property rights and core technologies. By the end of the reporting period, the company had applied for 502 invention patents, 101 utility model patents, 1 design patent and 21 PCT21 patents. A total of 107 invention patents, 79 utility model patents and 1 design patent were obtained.

On April 15th, 2022, China National Intellectual Property Administration announced the pre-winners of the 23rd China Patent Award, and the company’s patent "Load Chamber and Multi-chamber Processing System Using the Load Chamber" was shortlisted for the China Patent Excellence Award.

List of intellectual property rights acquired during the reporting period

3. R&D investment table

Reasons for significant changes in total R&D investment compared with the previous year

During the reporting period, the company continuously enriched the product categories, expanded the application fields of technology, and continuously increased the investment in R&D. The company invested 118 million yuan in R&D in this period, up 45.66% year-on-year, mainly due to the direct investment in R&D and the increase in the salary of R&D personnel.

Reasons for the great change in the capitalization proportion of R&D investment and its rationality

4. Research projects

5. R&D personnel

6. Other explanations

Second, the discussion and analysis of the business situation

During the reporting period, the company has been deeply involved in the field of high-end semiconductor equipment, focusing on the research and development and industrial application of thin film deposition equipment. Focusing on the national special strategic layout, facing the development of domestic integrated circuit chip manufacturing technology and market demand, the company gives full play to its advantages in R&D team, technical reserve, customer resources and after-sales service, seizes the market opportunity of rapid development of domestic semiconductor industry, persists in driving business development with technology and product innovation, continuously maintains the R&D and investment of new products, new processes and new technologies, enhances the market competitiveness of products, and at the same time, continuously strengthens the operation and management of the company to promote its sustained, steady and rapid development.

1. Main business conditions

During the reporting period, the company’s products continued to maintain their competitive advantage, and benefited from the capacity expansion of downstream fabs and the strong support of national policies for domestic equipment. The company’s product sales increased significantly year-on-year, achieving an operating income of 523,216,900 yuan, an increase of 364.87% over the same period of last year, and the operating income increased significantly; The net profit attributable to shareholders of listed companies was 108,122,700 yuan, and the net profit attributable to shareholders of listed companies after deducting non-recurring gains and losses was 49,150,300 yuan, turning losses into profits compared with the same period of last year, and the profitability continued to increase.

During the reporting period, the company realized the main business income of 516,667,400 yuan, an increase of 392.56% over the same period of last year. The analysis of the company’s main business by product category is as follows:

During the reporting period, the company’s main business income mainly came from the sales income of PECVD equipment, ALD equipment and SACVD equipment, among which PECVD equipment was the most important source of the company’s main business income, while ALD equipment and SACVD equipment realized income compared with the same period.

2. The company’s product development and industrialization progress

During the reporting period, the company continued to maintain a high level of R&D investment, gradually improved the technological innovation capability of existing products, maintained the core competitiveness of products, continuously enriched the types of equipment, and broadened the coverage of film technology products, and made breakthroughs and progress in product industrialization and new product research and development.

(1) Progress of industrialized application of existing products

①PECVD series products

During the reporting period, the company’s PECVD(PF-300T (two-station)) equipment continued to maintain its competitive advantage, the order volume increased steadily, and the market share continued to increase, which has been accepted by existing and new customers. By the end of the reporting period, the company’s PECVD(PF-300T) equipment has been widely used in domestic wafer manufacturing production lines, including 28nm and above logic chips, 3DNANDFLASH, DRAM memory chip manufacturing and other fields.

PECVD(NF-300H (six-station)) equipment introduced by the company has achieved the first industrial application in the field of DRAM memory chip manufacturing, and can deposit ThickTEOS dielectric thin films. The equipment can process up to 18 wafers at a time, with high yield and good performance index, which broadens the application coverage of the company’s process.

②ALD series products

During the reporting period, the verification of the company’s PE-ALD series products in the manufacturing fields of logic chips, 3DNANDFLASH and DRAM memory chips progressed smoothly, and the ALD reaction chamber passed the acceptance of existing customers. At the same time, the company is oriented by customer demand and actively deploys the application and expansion of PE-ALD advanced film technology. By the end of the reporting period, the company’s PE-ALD series products have been industrialized in the field of logic chips, which can deposit SiO2 _ 2 dielectric materials with high temperature, low temperature and high quality.

By the end of the reporting period, the company’s Thermal-ALD(PF-300T (two-station)) equipment has completed product development and obtained customer orders, and has been continuously optimized and improved according to customer index requirements.

③SACVD series products

During the reporting period, the company’s SACVD products continued to expand their application fields, and BPSG and SATEOS thin film processes obtained customer acceptance in the field of 40/28nm logic chip manufacturing. By the end of the reporting period, SACVD products of the company have been widely used in the field of logic chip manufacturing of 12-inch 40/28nm and 8-inch 90nm or above, and have obtained orders from existing and new customers.

(2) Progress of new products

During the reporting period, the company continuously enriched the types of equipment in the field of CVD subdivision, expanded the product coverage, and developed TS-300 (polygonal high-yield platform), Thermal-ALD based on high-yield platform, and high-density plasma enhancement.

Learn new products such as vapor deposition (HDPCVD) equipment and ultraviolet curing treatment (UVCure) equipment, and make breakthroughs and progress. The details are as follows:

①TS-300 (Polygon High-yield Platform)

Based on the existing platform, the company developed and designed the design of hexagonal transmission platform, which can carry up to five reaction chambers (10 reaction stations) at the same time, improve the productivity of thin film deposition equipment, and at the same time, integrate and combine various processes to realize continuous multi-step deposition in vacuum environment. The company’s polygonal high-capacity platform can be equipped with PECVD reaction chamber, ALD reaction chamber and HDPCVD reaction chamber, and has obtained orders from existing and new customers.

②ALD series products

Based on Thermal-ALD(PF-300T (Two-station)) equipment, the company developed Thermal-ALD(TS-300 (Polygonal High-yield Platform)) equipment, which can improve the production capacity, at the same time, integrate and combine various thin film processes, and can deposit various metal compound thin film materials such as Al2O3 and AlN, and has obtained customer orders.

③HDPCVD series products

High-density plasma enhanced chemical vapor deposition (HDPCVD) equipment can deposit and sputter thin films at the same time, so as to fill trenches with the aspect ratio less than 5:1. The films deposited by HDPCVD have higher density and lower impurity content, which is mainly suitable for the field of 130-55nm process logic chip manufacturing. The company has developed HDPCVD(PF-300T (single station)) equipment and HDPCVD(TS-300 (polygonal high-yield platform)) equipment, which can deposit thin films of dielectric materials such as SiO2 _ 2, FSG and PSG. HDPCVD series (PF-300T (single station)) equipment has been shipped to the client for industrial verification. Both of the above two equipments have obtained customer orders.

④UVCure equipment

UVCure equipment is mainly used for ultraviolet curing of thin films, which can effectively improve the efficiency and thermal budget of post-treatment process of thin films, and improve key performance indexes such as stress, granularity and hardness of thin films. The company’s UVCure equipment has been designed and developed, which can be used in complete sets with PECVD equipment to carry out UV curing treatment for PECVDLokII, HTN and other thin film deposition. It has been shipped to the client for industrial verification and obtained customer orders.

3. Supply chain security

The company continuously optimized the supply chain management system and established a multi-dimensional coordination mechanism covering production and inventory management, procurement management and logistics management. The company has always attached great importance to the cultivation of suppliers, continuously improved the supplier support and performance appraisal mechanism, and promoted the continuous improvement of supplier product quality and product performance. Under the background of global supply chain tension and epidemic situation, the company strengthened the depth and scope of cooperation with suppliers, constantly adjusted and optimized the supply chain structure by planning in advance and sharing demand forecast, and adopted a global and multi-source supply strategy. At the same time, according to customer demand and R&D demand, the volume and progress of parts procurement are reasonably planned to ensure the timely and stable supply of key parts. During the reporting period, the company’s upstream supply chain remained generally stable, effectively ensuring the smooth progress of production.

4. Market sales

During the reporting period, the company continued to focus on the thin film deposition market in Chinese mainland, and seized the market opportunities brought by the expansion of domestic downstream wafer manufacturing plants. With the core competitive advantages of the company’s products, the market share and customer recognition continued to increase: (1) the company’s three series of products and new products, PECVD, ALD and SACVD, obtained existing and new customer orders; (2) The verification of the company’s products in the customer’s production line progressed smoothly and achieved good results. The scale of mass production and application in the wafer manufacturing production line continued to expand, and the sales volume of products increased significantly year-on-year; (3) The company continues to maintain in-depth and stable cooperation with downstream customers and continue to provide customized high-performance products, laying a solid foundation for the company’s future business growth.

5. Talent team building

During the reporting period, the company continued to strengthen the construction of talent echelon and expand the scale of personnel according to the needs of business development. In terms of talent introduction, actively attract experienced management and technical talents in the industry, and select outstanding graduates from domestic universities. In terms of personnel training, the company continuously optimizes the training system, gives full play to the performance appraisal and incentive mechanism, and enhances the sense of honor and cohesion of employees; Continue to strengthen close cooperation with universities and implement targeted recruitment linked with factories and schools; Establish a joint training mechanism with domestic universities to train reserve talents directionally, which provides strong support for the construction of the company’s talent team.

6. Operation management

During the reporting period, the company continuously improved the product manufacturing level, optimized the material operation management, and effectively improved the timely rate and qualified rate of assembly and manufacturing. The company continuously strengthens the product quality management system, and maintains a high level of after-sales technical support services to enhance customer satisfaction. The company has an EHS (Environment, Health and Safety) compliance management department to supervise the company’s production and operation to ensure the compliance and safety of the company’s production. The company actively arranges information system technical protection and security management to ensure the company’s network security and data security.

7. The company’s initial public offering and progress in the construction of fundraising projects.

During the reporting period, the company completed the initial public offering and listed on the science and technology innovation board of Shanghai Stock Exchange. This initial public offering issued 31,619,800 shares of RMB common stock (A shares) to the public, with the par value of RMB 1 yuan per share, and the issue price was RMB 71.88 per share. The total amount of funds raised was RMB 2,272,831,200. After deducting the issuance expenses of RMB 145,234,000, The success of the company’s initial public offering provides a strong financial guarantee for the company to expand its production scale and develop new technologies and products.

The Company’s fundraising project "High-end Semiconductor Equipment Expansion Project" is the expansion project of "Semiconductor Film Equipment Industrialization Base (Phase I) Project", and the second phase of clean workshop construction, supporting facilities and production automation management system construction are carried out on the basis of the company’s original semiconductor film equipment R&D and production base. During the reporting period, the second-phase clean workshop was basically completed and put into production, and the layout of production automation management system was carried out at the same time.

The third fundraising project, ALD Equipment R&D and Industrialization Project, relies on the advantages of integrated circuit industrial cluster in the new area and talents in Shanghai, and strives to recruit first-class R&D teams to conquer high-end chip manufacturing thin film deposition equipment. During the reporting period, the company’s R&D and industrialization base construction is progressing smoothly, and ALD products have been developed.

8. Foreign investment

During the reporting period, the Company made the following investments:

(1) Establish a wholly-owned subsidiary in the United States.

During the reporting period, the company set up a wholly-owned subsidiary, Tuojing USA. The establishment of this company is conducive to the company to strengthen supply chain cooperation and investigate the international market. As of the end of the reporting period, Tuojing USA has not actually operated.

(2) Capital increase to Tuojing Shanghai

On June 17, 2022, the company held the 11th meeting of the first board of directors, deliberated and passed the Proposal on Using the raised funds to increase capital to wholly-owned subsidiaries to implement fundraising projects, and agreed that the company would use the raised funds to increase capital to Tuojing Shanghai by 270 million yuan to implement the fundraising project "ALD Equipment R&D and Industrialization Project". After this capital increase, the company will accelerate the research and development and industrialization of ALD equipment, improve the layout of the company’s product line and improve the market competitiveness of the company’s products. On July 20, 2022, the company has paid the capital increase to Tuojing Shanghai. On August 9, 2022, Tuojing Shanghai completed the registration of industrial and commercial changes.

(3) Capital increase to Hengyunchang and equity participation in Hengyunchang

On June 17th, 2022, the company held the 11th meeting of the first board of directors, deliberated and passed the Proposal on Foreign Investment and Participation in Shenzhen Hengyunchang Vacuum Technology Co., Ltd., and agreed that the company would increase its capital to Hengyunchang by RMB 20 million with its own funds, accounting for 35,088% of the total share capital of Hengyunchang after the capital increase. Hengyunchang is mainly engaged in R&D, production and sales of RF power supply for semiconductor equipment, photovoltaic and industrial equipment, and has supplied RF power supply, RF matcher and other products for the company. This capital increase is conducive to the company to improve its industrial layout, which is consistent with the company’s strategic layout, has a synergistic effect with its main business, and can enhance the stability of the company’s upstream supply chain. On July 14th, 2022, the company has paid the capital increase to Hengyunchang. On August 8, 2022, Hengyunchang completed the registration of industrial and commercial changes.

9. Corporate governance

During the reporting period, the Company held a general meeting of shareholders, five meetings of the Board of Directors, one meeting of the Audit Committee of the Board of Directors, one meeting of the Remuneration and Assessment Committee of the Board of Directors and two meetings of the Board of Supervisors.

As a listed company, the company has continuously improved its governance structure in strict accordance with the requirements of the Company Law, the Securities Law, the science and technology innovation board Stock Listing Rules of Shanghai Stock Exchange and the Articles of Association of Tuojing Technology Co., Ltd., so as to improve the scientificity, rationality, compliance and effectiveness of management decisions, improve the level of corporate governance and standardized operation, and lay a good foundation for the realization of the company’s business objectives.

10. Company information disclosure and prevention of insider trading.

The company attaches great importance to the standardized operation of listed companies, information disclosure management and investor relations management. According to the relevant laws, regulations and departmental rules, the company has formulated internal systems for regulating the operation of shareholders’ meeting, board of directors, board of supervisors, information disclosure and investor management, and strictly abided by them. The company earnestly fulfills its obligation of information disclosure to ensure the timeliness, truthfulness, accuracy and completeness of information disclosure; Communicate with investors through investor conference call, fax, e-mail and interactive platform for investor relations, and receive on-site investigation of investors, so as to establish a good interactive relationship.

The company attaches great importance to the prevention of insider trading, and completes the registration management of insider information and the prevention of insider trading. Give warnings and education to directors, supervisors, senior managers and relevant employees of the company on a regular basis to prohibit insider trading, and urge directors, supervisors, senior managers and relevant insiders to strictly fulfill their confidentiality obligations and strictly abide by the regulations on stock trading.

Major changes in the company’s operation during the reporting period, as well as matters that have a significant impact on the company’s operation during the reporting period and are expected to have a significant impact in the future.

Third, possible risks

(A) operational risks

1. The risk that the expansion of the wafer factory is less than expected.

The scale of capacity investment in downstream fabs determines the market space of semiconductor special equipment. The expansion investment of the wafer factory has a certain periodicity. If the investment intensity of the downstream fabs decreases, the company will face a decline in market demand, which will adversely affect the company’s operating performance.

Under the background of localization of semiconductor equipment, the company will continuously strengthen its product market competitiveness, improve the trust of existing customers and continuously expand new customers through continuous research and development; The company will always pay attention to the development stage of the semiconductor industry cycle, coordinate all aspects of the company’s purchase, production and sales according to market conditions, and maintain the coordination between the company’s business activities and the industry cycle; At the same time, the company will always ensure that the cash flow is reasonable and sufficient to avoid the company’s operation in the downturn of the industry.

2. Market competition risk

At present, the company’s competitors are mainly internationally renowned semiconductor equipment manufacturers. Compared with Chinese mainland’s semiconductor special equipment enterprises, the international giants have the first-Mover advantage of clients, and the company’s comprehensive competitiveness is in a weak position and its market share is low. In addition, domestic semiconductor equipment manufacturers may enter each other’s business fields and develop similar products. The company faces double competition from international giants and potential new domestic entrants. If the company cannot effectively cope with the market competition environment, its industry position, market share and operating performance will be adversely affected.

At present, the company is the only manufacturer of integrated circuit PECVD equipment and SACVD equipment for industrial application in China. The company will continue to pay attention to the development of foreign competitors, shorten the technology gap with foreign manufacturers through continuous and effective R&D investment, and at the same time pay close attention to the domestic competition pattern to continuously enhance the core competitiveness of products; The company will always pay attention to the competitive situation of the industry, set the direction of research and development scientifically and reasonably, speed up the progress of research and development, and build a higher barrier to entry into the industry; At the same time, the company will also maintain closer cooperation with customers to achieve common growth with downstream customers.

3. Risk of long product acceptance period

The technical parameters of thin films deposited by thin film deposition equipment directly affect the performance of chips. In production, it is not only necessary to detect the film after it is formed

The performance indexes such as thickness, uniformity, optical coefficient, mechanical stress and granularity need to be completed in the wafer production process and chip sealing.

After installation, the reliability and life cycle of the final chip product are tested to measure whether the thin film deposition equipment finally meets the technical standards.

Therefore, the verification time required by the wafer factory for thin film deposition equipment may be longer than other semiconductor special equipment. If affected by some factors, the acceptance period of the company’s products will be extended, the company’s income confirmation and collection will be delayed, which will increase the company’s financial pressure and affect the company’s financial situation.

With the gradual expansion of the application scale of the company’s integrated circuit manufacturing production line, the company’s product technology is becoming more and more mature, and under the efficient and stable cooperation mechanism with customers, the product verification cycle is gradually shortened. The follow-up company will continue to pay attention to the company’s product acceptance and payment, and ensure the sustained and healthy development of the company’s operations.

4. The loss of technical personnel and the risk that high-end technical personnel cannot be continuously introduced.

Semiconductor equipment is a typical technology-intensive industry. In recent years, the domestic semiconductor special equipment market and wafer manufacturing demand are increasing, the competition for talents in the industry is becoming increasingly fierce, and there is a serious shortage of professional and technical talents. If the company can’t continue to provide better salary and development platform for technical talents and attract high-end technical talents from all over the world, it will face the situation of loss of technical talents and insufficient reserves, which may lead to insufficient innovation ability of the company.

The company provides R&D personnel with competitive salary and benefits in the market, continuously improves the performance evaluation and assessment promotion mechanism, and realizes the long-term common development of employees and the company. During the reporting period, there was no loss of core technicians, which ensured the stability of the core R&D team.

5. Risk of technological innovation

With the development and iteration of technology in semiconductor industry, the demand of downstream customers for thin film deposition equipment and performance also changes. Therefore, the company needs to maintain a high R&D investment and maintain the core competitiveness and advanced level of its products. If the company fails to accurately understand the requirements of downstream customers’ production line equipment and process technology evolution in the future, or the technological innovation products cannot meet the needs of customers, it may lead to the company’s equipment failing to meet the manufacturing needs of downstream production lines, which may adversely affect the company’s operating performance.

The company has established a scientific R&D system, with technical innovation closely following the market demand, and the R&D project is guided by customer demand, and always keeps continuous and effective communication with customers, so as to avoid possible losses caused by technical R&D failure.

(B) Financial risks

1. Risk of changes in government subsidy policies

During the reporting period, the government subsidies received by the company mainly supported the company’s R&D investment. In the future, if the government departments’ policy support for the company’s industry is weakened, or other subsidy policies are adversely changed, the amount of government subsidies obtained by the company will be reduced, and the company will need to invest more self-raised funds for research and development, which will affect the company’s cash flow. In addition, the reduction of government subsidies will also have a certain adverse impact on the company’s operating performance.

The company will continue to expand its business scale and improve its profitability, so as to gradually reduce its dependence on government subsidies.

2. The risk of unsustainable profitability

During the reporting period, the company’s net profit attributable to shareholders of listed companies was 108,122,700 yuan, and the net profit attributable to shareholders of listed companies after deducting non-recurring gains and losses was 49,150,300 yuan, turning losses into profits compared with the same period of last year. However, the company needs to maintain a large amount of investment in future R&D activities. If the progress of the company’s R&D projects or the sales of major products are less than expected, the company may have a performance that is less than expected, and there is a risk of unsustainable profitability.

Guided by market demand, the company will continue to enrich its product categories, optimize its product structure, enhance its core competitiveness, and continuously expand its market scale, so as to ensure its operating performance and enhance its profitability.

(C) Macro-environmental risks

1. The risk of increasing international trade friction affecting the safety of the company’s supply chain

In recent years, international trade friction has been constant, and Sino-US trade friction has aggravated the instability of global supply chain. At present, some parts of the company still need to be purchased from foreign suppliers. If the international trade friction intensifies further, the above-mentioned foreign suppliers may be affected by relevant policies to reduce or stop supplying parts to the company, thus affecting the company’s product production capacity, production schedule and delivery time, and reducing the company’s market competitiveness.

Companies and suppliers actively carry out deeper and broader cooperation, adopt a global and multi-source supply strategy, and build a stable cooperation channel to strengthen their own supply chain security and reduce the risks brought by the instability of the international industrial chain.

2. COVID-19 epidemic risk

At present, the epidemic situation in COVID-19 is still spreading around the world, and China is under great pressure to prevent and control the epidemic situation. If a large-scale epidemic breaks out in the place where the company operates, it will adversely affect the company’s production, sales and delivery. In addition, the spread of the epidemic may affect the healthy development of the upstream and downstream of the industry to a certain extent, which may adversely affect the production and operation of the company’s raw material supply and product transportation.

The company attaches great importance to the prevention and control of epidemic situation, always pays attention to the epidemic situation, and continuously improves the production and operation management mechanism under the situation of normalized epidemic situation. During the reporting period, the COVID-19 epidemic did not have a substantial impact on the company’s business.

Iv. analysis of core competitiveness during the reporting period

(A) analysis of core competitiveness

The company is committed to the research and development and production of world-leading semiconductor thin film equipment, and always insists on independent innovation to continuously provide competitive products for the semiconductor industry and customers. The company has established an innovative management system, and has formed competitive advantages in R&D team, technology accumulation and R&D platform, market expansion and after-sales service, which are embodied as follows:

1. It has rich technical reserves and international advanced core technology advantages.

Since its establishment, the company has adhered to independent innovation, formed a series of original designs and built a perfect intellectual property system. By the end of the reporting period, the company had obtained 187 authorized patents, including 107 invention patents.

The company has successively undertaken seven major national special projects/projects, and has developed PECVD, ALD and SACVD equipment supporting different process models, accumulated a number of core technologies for research and development and industrialization in the field of semiconductor thin film deposition equipment, and built a research and development platform with the ability to extend the development of equipment types and process models.

Facing the actual demand of domestic semiconductor manufacturing industry and the evolution rhythm of production line, the company has reserved advanced dielectric material technology thin film deposition technology below 28nm in the field of logic circuit application, 3DNAND and DRAM dielectric thin film deposition technology in the field of memory chips, and dielectric thin film deposition technology needed in the field of advanced packaging, such as TSV, 2.5D-IC and 3D-IC integration. In the future, the company will insist on high-intensity R&D investment, continuously upgrade and optimize existing equipment and processes, and constantly introduce new technologies and equipment for future development needs.

2. Excellent technical research and development and management team advantages.

The company has built an international and professional research and development and management team of semiconductor thin film deposition equipment technology. The founding team of the company takes returned overseas experts as the core, based on core technology research and development, actively introduces overseas high-level talents and independently trains local scientific research teams.

The company’s international and professional senior management team and the incentive system of full shareholding have attracted a large number of experienced domestic and foreign semiconductor equipment industry experts to join the company and made outstanding contributions in machine design, process design and software design. Since its establishment, the company has cultivated its own local research team. With the successful research and development of many products, the company’s local research team has grown into the backbone of the company’s technology research and development. By the end of the reporting period, the company had 296 R&D personnel, accounting for 43.72% of the company’s total employees. The company’s R&D technical team has a reasonable structure, clear division of labor, profound professional knowledge and rich experience in production line verification, which is the cornerstone of the company’s technical strength and guarantees the market competitiveness of its products. During the reporting period, the company’s core technical team was stable and there were no major adverse changes.

3. Leading position in the industry and rich advantages in customer resources.

With the vision of establishing "the world’s leading thin film equipment company", the company has become a leading enterprise in the domestic semiconductor equipment industry through the accumulation and rapid development in the field of thin film deposition equipment, a semiconductor core equipment subdivision.

The company has formed a relatively stable cooperative relationship with domestic semiconductor industry enterprises. The company’s main products PECVD, ALD and SACVD equipment have been sent to the production lines of major integrated circuit fabs in China in batches. In addition, the company actively pays attention to the international market demand and explores the international market in a timely manner.

4. Stable supply chain and low operating cost advantage.

The company has established a perfect supply chain management system, absorbed and accumulated global supply chain resources, established strategic cooperative relations with key suppliers, and built a stable supply chain structure. Through periodic evaluation and examination of suppliers, suppliers are encouraged to improve product quality, delivery time and cost control, so as to improve the competitiveness of enterprises. Based on collaboration, the company interacts with suppliers in real time to jointly carry out agile collaborative product innovation and maintain a good and stable cooperative relationship.

The company’s main competitors are located in the United States and Japan, and the cost of serving customers in Chinese mainland is high. The company’s R&D and production are mainly located in Chinese mainland, which has a geographical advantage. In terms of product design, the company works closely with suppliers to make products modular and easy to maintain, thus reducing the company’s raw material procurement costs. With the continuous maturity of local suppliers, the company has been given more purchasing options. Therefore, compared with its main competitors, the company has certain advantages in operating costs, and with the continuous improvement of production capacity, the advantage of cost reduction will be more obvious.

5. Provide customized products and efficient after-sales service advantages.

The company’s rapid response ability to the specific process materials and specific manufacturing processes put forward by customers can meet the needs of customized equipment in customer production lines in time. This is extremely important for local customers in China to rapidly expand their production capacity in recent years, thus establishing and consolidating a stable cooperative relationship with customers. The production base of the company’s main customers is located in Chinese mainland. Compared with international competitors, the company’s top management and technical team are closer to the main customers, and can provide efficient and timely technical support and after-sales service to ensure and meet customer needs in time.